When a brand-name drug’s patent expires, you’d expect a generic version to hit the market quickly-cheaper, just as effective, and available to millions. But that’s not always what happens. Behind the scenes, a complex web of court rulings, patent filings, and regulatory rules determines whether a generic drug can launch-or gets stuck in legal limbo for years. These aren’t abstract legal debates. They directly affect how much you pay for insulin, blood pressure meds, or cancer treatments.

How Generic Drugs Get Stuck in Court

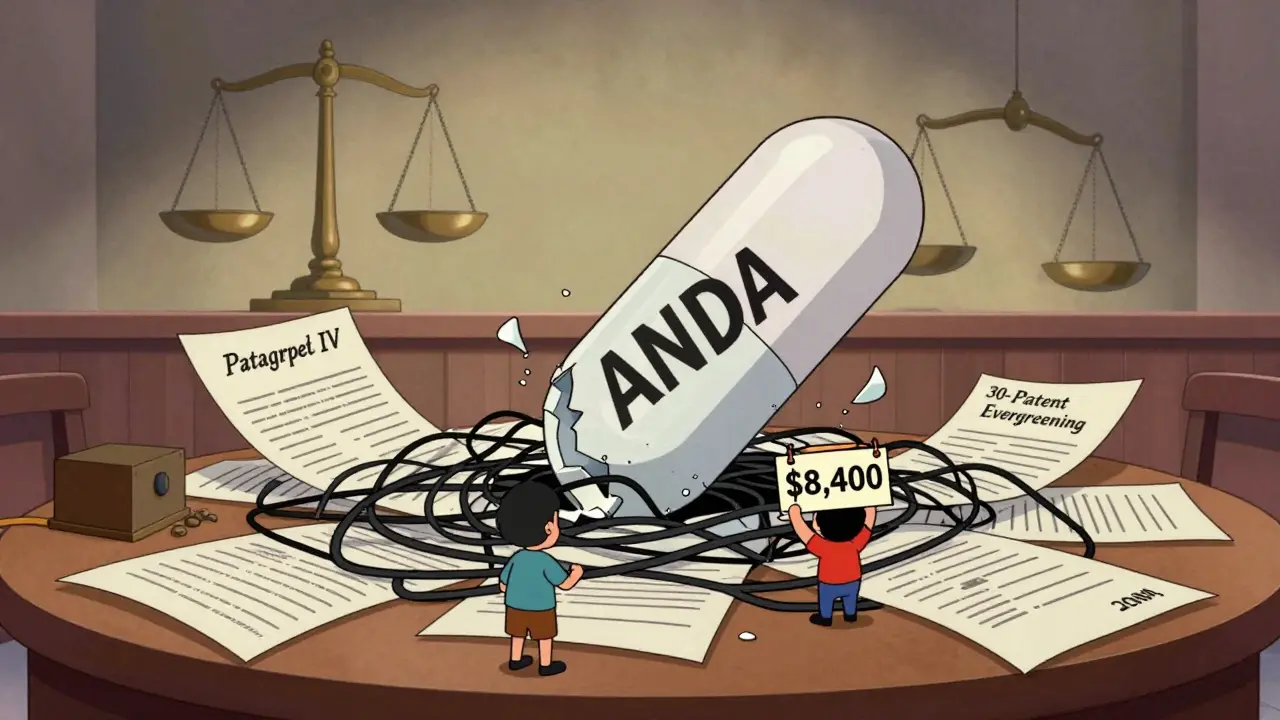

The system was designed to balance innovation with access. In 1984, Congress passed the Hatch-Waxman Act to fix a broken drug market. Before then, brand companies could delay generics indefinitely by filing endless patents. Generic makers had no clear path to enter. Hatch-Waxman changed that. It let generic companies file an ANDA-Abbreviated New Drug Application-without repeating costly clinical trials. But here’s the catch: they had to certify whether the brand’s patents were valid or not. That’s where Paragraph IV certification comes in. If a generic company says a patent is invalid or won’t be infringed, the brand gets a 30-month automatic stay. That’s not a trial. It’s a legal freeze. During those 30 months, the generic can’t launch-even if the patent is weak. And in practice, many of these stays become multi-year delays. In 2023, over 2,100 of these cases were filed in the U.S. alone. That’s more than six a day.The Amgen v. Sanofi Decision: A New Bar for Biologic Patents

One of the biggest shifts came in 2023 with Amgen v. Sanofi. Amgen held a patent on a class of cholesterol drugs that claimed millions of possible antibody variations-but only showed 26 actual examples. The Supreme Court said that’s not enough. You can’t patent something you haven’t actually made or described in detail. This wasn’t just about one drug. It changed the whole game for biologics-complex drugs made from living cells, like cancer treatments and autoimmune therapies. Before this ruling, companies could file broad patents covering huge families of molecules, then sue any generic that came close. Now, they need to prove they actually invented what they’re claiming. The result? Generic makers are seeing more opportunities. But it’s also making it harder for biotech startups to secure funding. Investors are nervous: if your patent is too broad, it might get thrown out.Allergan v. Teva: The First-to-File Rule That Protects Brand Patents

In contrast, the 2024 Allergan v. Teva decision gave brand companies a powerful shield. Allergan had filed a patent for a glaucoma drug in 2010. Teva later filed a different patent on the same drug-but with an earlier expiration date. Teva argued that since their patent expired sooner, it shouldn’t block generic entry. The court said no. The first patent listed in the Orange Book controls. Even if a later patent has a shorter term, it can still be used to delay generics. This decision is a game-changer. It means brand companies can stack patents-file one just before expiration, list it in the Orange Book, and reset the 30-month clock. It’s called “patent evergreening,” and now it’s legally protected. Generic makers say this undermines the whole point of Hatch-Waxman. Brand companies say it’s fair-they invested in the drug, they deserve protection.

Amarin v. Hikma: When Marketing Materials Become Infringement

Most people think infringement means copying a drug’s formula. But in Amarin v. Hikma, the issue wasn’t the drug-it was the label. Amarin’s drug was approved for one use: lowering triglycerides. Hikma’s generic was approved for the same use. But Hikma’s marketing materials mentioned a second, unapproved use: reducing heart attack risk. Amarin sued, claiming this “induced infringement.” The court agreed. This is subtle but dangerous. Generic companies are now being sued not for making the drug, but for what they say about it in brochures, websites, or sales pitches. In 2023, 63% of induced infringement claims succeeded. It’s a new tactic: use the law to scare generics into silence. The result? Many generics now use ultra-conservative labeling-even if the science supports broader use. Patients lose out. Doctors lose flexibility. And the cost of legal review has gone up by an average of $1.2 million per product for generic manufacturers.Why This Matters to You

These cases aren’t just for lawyers. They’re about your wallet. When a generic drug enters the market, prices drop 80-85% within a year. That’s not a guess. The FTC confirmed it in 2023. But if litigation delays that entry by two or three years, you’re paying hundreds or thousands more than you should. Take insulin. In 2024, a patient in Ohio paid $8,400 out-of-pocket because the generic version was held up by patent litigation for 22 months. That’s not rare. Evaluate Pharma estimates $127 billion in generic drug sales are stuck in litigation through 2026. Cardiovascular and oncology drugs are the worst offenders. And it’s not just about price. It’s about access. If you’re on a fixed income, or you’re uninsured, or you’re juggling multiple prescriptions, a delayed generic isn’t an inconvenience-it’s a health crisis.

What’s Changing Now?

The FDA is pushing back. In 2025, they proposed new rules to clean up the Orange Book. They want to remove patents that have nothing to do with the drug’s actual use. No more listing a patent for a pill’s color or packaging just to block generics. The FTC is also stepping up. Their 2024 policy statement says they’ll go after “improper listings” with enforcement actions. RBC Capital Markets predicts this could cut artificial delays by 15-20%. Meanwhile, the Patent Trial and Appeal Board (PTAB) is becoming the main battlefield. In 2023, 78% of generic challenges used inter partes review (IPR)-a faster, cheaper way to knock out bad patents than district court. That’s up from 45% just five years ago. It’s not perfect. But it’s helping.What You Can Do

You can’t change the law. But you can be smarter about how you use it. - Ask your pharmacist: “Is there a generic available? If not, why?” Sometimes, the answer is simple: it’s not on the market yet because of litigation. - Check the FDA’s Orange Book online. It’s free. You can see which patents are listed and when they expire. - If you’re paying high prices for a brand drug, ask your doctor about alternatives. Sometimes, another drug in the same class has already gone generic. - Support policy changes. Contact your representatives. Ask them to back the FDA’s proposed Orange Book reforms. The system is rigged in favor of big pharma-but it’s not broken beyond repair. Landmark cases like Amgen and Allergan are reshaping the rules. And with more transparency, more pressure, and more awareness, the balance can shift back to patients.What is the Hatch-Waxman Act and how does it affect generic drugs?

The Hatch-Waxman Act of 1984 created a legal pathway for generic drug manufacturers to bring cheaper versions of brand-name drugs to market without repeating expensive clinical trials. It allows generics to file an ANDA and challenge patents through Paragraph IV certification. In return, the first generic to file gets 180 days of market exclusivity. The law was meant to balance innovation with affordability-but today, patent litigation often delays generic entry for years.

What is Paragraph IV certification?

Paragraph IV certification is a legal statement a generic drug company files with the FDA, claiming that a brand-name drug’s patent is either invalid or won’t be infringed. This triggers a lawsuit from the brand company and automatically pauses generic approval for up to 30 months. It’s the main tool generics use to challenge patents-but it’s also the primary reason many generics are delayed.

Why do some patents get listed in the Orange Book even if they seem unrelated to the drug?

Some brand companies list patents that cover packaging, manufacturing methods, or even off-label uses-not the actual active ingredient. This tactic, called “evergreening,” extends monopoly protection beyond the core patent. The FDA is now pushing to remove these improper listings, but enforcement has been slow. Until then, these patents can still trigger 30-month stays and block generics.

How do I find out if a drug’s generic is delayed because of a patent lawsuit?

Check the FDA’s Orange Book database online. It lists all patents tied to brand-name drugs and shows if any have been challenged. You can also ask your pharmacist or check websites like Drugs.com, which often note if a generic is pending due to litigation. If a drug has been on the market for years but still has no generic, a patent dispute is likely the cause.

Can I use a generic drug if it’s approved but not on the market yet?

No. Even if the FDA approves a generic, it can’t be sold until all patent disputes are resolved. The brand company can legally block distribution during a 30-month stay. You’ll need to wait until the court rules, the patent expires, or the generic wins exclusivity. There’s no legal workaround.

John Hay

December 20, 2025 AT 13:39The Hatch-Waxman Act was supposed to be a win for patients, but now it’s just a loophole for pharma to buy time. Every 30-month stay is another year people can’t afford their meds. This isn’t innovation-it’s extortion dressed up as IP law.

Stacey Smith

December 21, 2025 AT 09:58Generic drugs should be cheaper, not legally blocked. Big Pharma owns Congress. Time to break their grip.

Ben Warren

December 23, 2025 AT 06:42It is imperative to recognize that the legal architecture governing pharmaceutical patent litigation is not merely a procedural matter, but a structural safeguard of incentivized innovation. The Supreme Court’s ruling in Amgen v. Sanofi, while ostensibly promoting precision in patent claims, inadvertently introduces undue uncertainty into the biologics sector, thereby undermining capital allocation and long-term R&D planning. The cumulative effect of judicial overreach, coupled with regulatory encroachment via FDA Orange Book reforms, threatens the very foundation of the U.S. pharmaceutical ecosystem.

Hannah Taylor

December 24, 2025 AT 13:27did u know the fda and big pharma are in bed together? they let them list patents for the color of the pill?? and the orange book is just a scam to keep prices high. the real cure? just print the drugs yourself. no patent can stop you if you make it in your garage. they dont want you to know this.

Michael Ochieng

December 25, 2025 AT 20:04This is a global issue. In Nigeria, we see people skipping doses because generics are delayed. The same legal games happen here, but we don’t have the resources to fight them. Patients everywhere are paying the price for corporate loopholes. We need international pressure on these patent abuses.

Cameron Hoover

December 27, 2025 AT 05:07I’ve watched this play out for over a decade. Every time I think the system might finally change, another court ruling pulls the rug out. But I still believe-if enough people speak up, if enough patients demand transparency-this can be fixed. We’re not powerless.

Teya Derksen Friesen

December 28, 2025 AT 08:22While the regulatory framework in the United States presents significant challenges, the Canadian system demonstrates that streamlined generic approval processes, coupled with robust public oversight, can mitigate the adverse effects of patent evergreening. A comparative policy analysis may offer actionable insights for reform.

Jason Silva

December 28, 2025 AT 14:49Big Pharma is running a scam 🤡 They patent the color of the pill, then sue you for saying it helps with heart attacks. I’ve seen it. My dad’s insulin cost $1,200 because of this. The PTAB is the only thing keeping them in check. #BreakThePatents

Meina Taiwo

December 29, 2025 AT 23:00Check the Orange Book. If a generic isn’t available after 5+ years, it’s a litigation delay. Always ask your pharmacist. Simple.

Adrian Thompson

December 30, 2025 AT 13:16They call it ‘patent protection’ but it’s really just a tax on the sick. The FDA’s new rules? Too little, too late. And the PTAB? Just a distraction. The real fix? Nationalize drug manufacturing. End of story.

Southern NH Pagan Pride

December 31, 2025 AT 00:43the orange book is a joke. they list patents for the shape of the capsule. and the courts just let it slide. its all a cover for price gouging. the fda is complicit. they know. they just dont care. i’ve seen the filings. its all scripted.

Orlando Marquez Jr

December 31, 2025 AT 20:34The evolution of patent law in pharmaceuticals reflects a necessary tension between proprietary rights and public health imperatives. While the Amgen v. Sanofi decision reinforces the enablement requirement, it also underscores the need for clearer statutory guidance from Congress to prevent judicial overinterpretation. Regulatory agencies must operate within their statutory mandates, not expand them through policy pronouncements.

Jackie Be

January 1, 2026 AT 23:18my brother died waiting for a generic insulin because of a patent lawsuit. this isnt about law. its about who gets to live and who doesnt. we need to burn the whole system down