Did you know that generic drugs saved the U.S. healthcare system $1.7 trillion over the last decade? That's because when multiple companies make the same drug, prices drop fast. Let's see how this works.

How Competition Drives Down Drug Prices

When a brand-name drug's patent expires, other companies can legally produce identical versions called generics. These generics must meet strict FDA standards for safety and effectiveness. But why does having more manufacturers lower prices? It's basic economics: more sellers mean more competition. Companies fight for customers by lowering prices. This keeps drug costs down for patients and insurers. The FDA U.S. Food and Drug Administration confirms that greater competition among generic drug makers directly leads to lower prices.

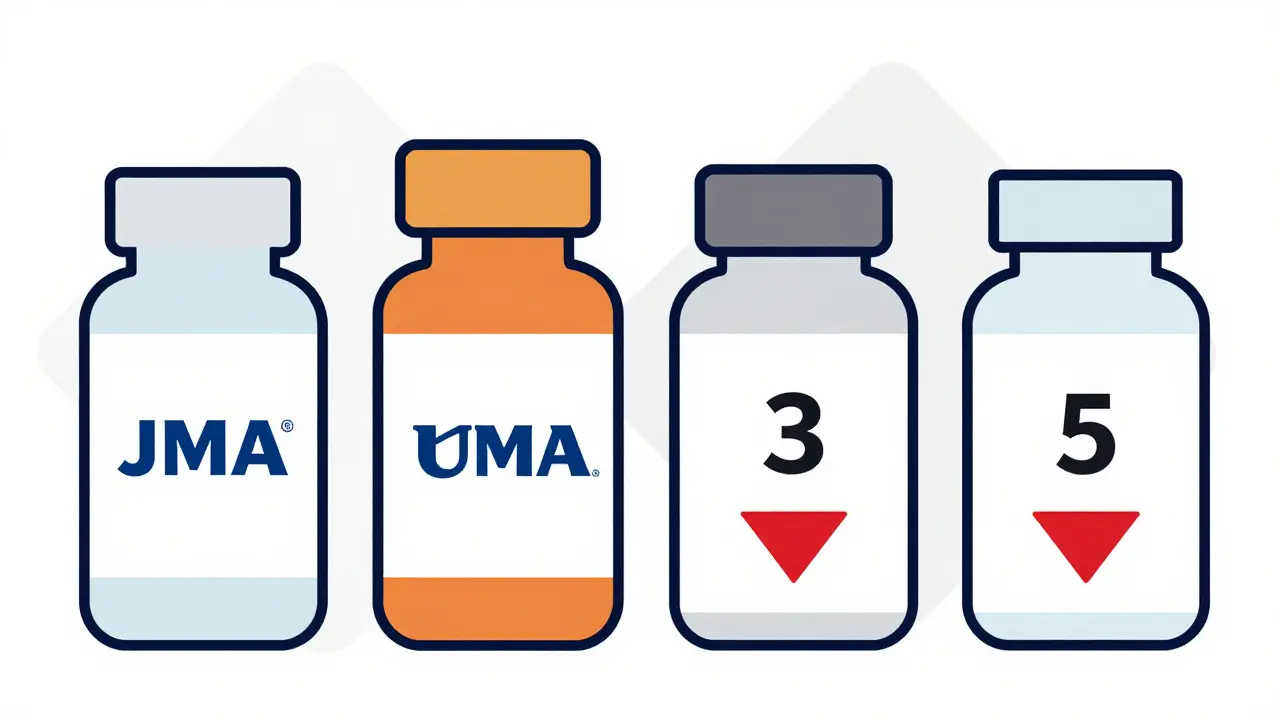

Real Numbers: How Many Competitors Equal Big Savings?

A JAMA Network Open medical journal study analyzed 50 brand-name drugs and their generic versions. They found clear patterns:

- First generic competitor: 17% average price drop

- Two competitors: 39.5% decrease

- Three competitors: 52.5% decrease

- Four or more competitors: 70.2% decrease

This data comes from Medicare Part B spending between 2015-2019. For example, if a brand-name drug cost $100, the first generic might drop to $83. With four competitors, it could fall to $29. The Hatch-Waxman Act Drug Price Competition and Patent Term Restoration Act of 1984 created this system, balancing innovation incentives with affordable generics.

Real-World Examples: Metformin vs. Levetiracetam

Take metformin, a common diabetes drug. With eight manufacturers competing, a 90-day supply often costs under $10. Patients using GoodRx price comparison service find consistent low prices across pharmacies. Now contrast this with levetiracetam, an epilepsy medication. When five manufacturers made it, prices stayed stable. But after consolidation reduced it to two companies, some patients saw price spikes of 300-500%. One Reddit user reported paying $300 for a 30-day supply where it once cost $60. This shows how fragile the system gets when competition is weak.

Why Some Drugs Don't See Price Drops

Biologics and biosimilars (used for cancer, autoimmune diseases) don't follow the same rules. They're complex to make, so fewer companies enter the market. A JAMA study found that if biosimilars were treated like generics, Medicare Part B spending on biologics would have been 27% lower. Infused or injected generics also see less competition than oral drugs. For example, insulin injections often have only one or two generic makers, keeping prices high. The Medicare Part B federal health insurance program for seniors system struggles with these complex drugs because reimbursement rules don't incentivize competition like they do for simple pills.

The Hidden Risk: Market Consolidation

Between 2014 and 2016, nearly 100 mergers happened among generic drug makers. Now, over half of generic drugs have just one or two manufacturers. The National Bureau of Economic Research NBER study found median sales revenues for generic manufacturers dropped to $800,000 annually. This consolidation creates near-monopolies where companies can raise prices without fear of competition. For instance, when one company stopped making a blood pressure drug, prices jumped 400% overnight. The FTC Federal Trade Commission now challenges mergers that reduce competition, but many slip through unnoticed.

How Patients Can Save Money Today

You don't have to wait for policymakers. Here's how to leverage competition:

- Use GoodRx to compare prices across pharmacies. It aggregates data from 70,000+ locations.

- Ask your pharmacist about therapeutic substitutions. The FDA's Orange Book lists drugs with therapeutic equivalence ratings shows which generics are safe to swap.

- Check if your state allows pharmacy substitution. All 50 states have rules, but implementation varies. California allows automatic substitution for most generics; Texas requires pharmacist approval.

- For narrow therapeutic index drugs (like warfarin), always confirm with your doctor before switching. Small changes can affect effectiveness.

What's Next for Generic Drug Competition?

The FDA's Generic Drug User Fee Amendments (GDUFA) III aims to speed up approvals and improve competition through 2027. The CREATES Act passed in 2019 blocks tactics that delay generic entry, like refusing to sell samples for testing. The Congressional Budget Office projects generic and biosimilar competition will save Medicare $158 billion by 2031. But experts warn that unchecked mergers could undermine these savings. The best way to keep prices low is to support policies that encourage more manufacturers to enter the market.

How many generic manufacturers are needed for the biggest price drops?

According to a JAMA Network Open study, four or more competitors lead to a 70.2% average price drop compared to the brand-name drug. The most significant savings happen between the first and third competitors, but prices keep falling with each additional manufacturer. For example, a drug costing $100 might drop to $83 with one generic, $60 with two, $47 with three, and $30 with four or more.

What happens when only one manufacturer makes a generic drug?

When only one company produces a generic drug, prices often rise rapidly. The FDA found that single-manufacturer generics can cost 2-3 times more than those with multiple competitors. For instance, when one company stopped making the generic version of the antibiotic ciprofloxacin in 2019, prices jumped 200% within months. Patients may also face shortages if that single manufacturer has production issues.

Can I trust generic drugs to be as effective as brand names?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage form, and route of administration as brand-name drugs. They must also meet the same strict quality standards. Generics are typically 80-85% cheaper because they don't repeat expensive clinical trials. The only differences are in inactive ingredients (like fillers), which rarely affect effectiveness.

Why don't biologics have the same price drops as generics?

Biologics are made from living cells, making them extremely complex to replicate. Biosimilars (the generic version of biologics) require extensive testing to prove similarity, which costs millions. This high barrier means fewer companies enter the market. For example, only 3 biosimilars exist for Humira (a top-selling biologic), while over 50 generics exist for common drugs like metformin. As a result, biologics stay expensive even after patents expire.

How can I find the cheapest generic option for my medication?

Use GoodRx or RxSaver to compare prices at local pharmacies. These tools show real-time pricing from thousands of locations. For example, a 30-day supply of lisinopril (a blood pressure drug) might cost $4 at Walmart but $15 at a specialty pharmacy. Also, ask your pharmacist about therapeutic equivalence ratings in the FDA's Orange Book. AB-rated generics are safe substitutes. Some states allow automatic substitution, while others require doctor approval.

Mark Harris

February 6, 2026 AT 04:48When four companies make a generic drug, prices drop 70% on average. That's massive. Metformin costs under $10 for 90 days with eight manufacturers, but levetiracetam spiked 500% when it was down to two. Competition saves lives and money. Everyone should check GoodRx before paying full price.

Natasha Bhala

February 6, 2026 AT 17:57I found my blood pressure med for $3 at Walmart using GoodRx. Same drug was $20 elsehwere. Always check prices before paying full price.

Marcus Jackson

February 6, 2026 AT 23:50FDA's Orange Book lists AB-rated generics as interchangeable. Always check that before switching meds. Saves cash and hassle. Don't just assume all generics are the same.