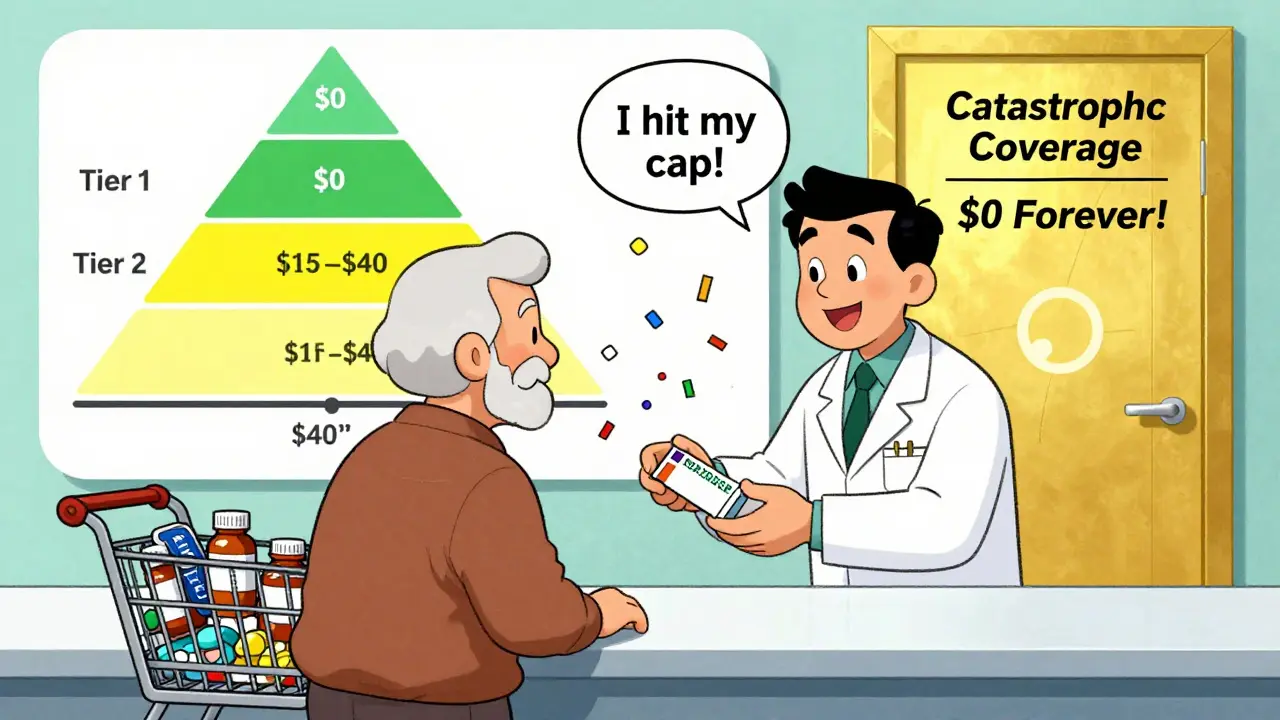

By 2025, Medicare Part D formularies are simpler for most people taking generic drugs than they’ve ever been. If you’re on multiple prescriptions, especially generics, you might be paying less than you ever thought possible. The big change? A hard cap on out-of-pocket drug costs at $2,000 a year. That means once you hit that number, your generic medications cost you $0 for the rest of the year. No more surprises. No more donut hole. Just steady, predictable pricing.

How Formularies Work: Tiers and Generic Drugs

Every Medicare Part D plan has a list of covered drugs called a formulary. This list is split into tiers, and generics almost always sit on the lowest ones. Tier 1 is for preferred generics - the cheapest, most commonly used versions of brand-name drugs. Think of drugs like lisinopril for blood pressure or metformin for diabetes. These usually cost $0 to $15 for a 30-day supply. Tier 2 holds non-preferred generics - still generics, but maybe less commonly prescribed or slightly more expensive. These might cost $15 to $40, or sometimes a percentage of the drug’s price.Why does this matter? Because your plan pays more for Tier 1 drugs. That’s why they’re cheaper for you. Plans use this system to nudge people toward the most cost-effective options. And it works. In 2023, 92% of all prescriptions filled under Medicare Part D were generics. That’s not a coincidence - it’s by design.

Costs in 2025: What You Actually Pay

In 2025, the deductible for most Part D plans is $615. After you pay that, you enter the initial coverage phase. Here’s where it gets simple: for generic drugs, you pay 25% of the cost. The plan covers the other 75%. So if your generic blood pressure pill costs $20, you pay $5. The plan pays $15.But here’s the twist: only the money you actually pay counts toward your $2,000 out-of-pocket limit. For brand-name drugs, the 70% discount from manufacturers also counts toward that cap. For generics? Only your payment matters. That means if you’re on a lot of generics, you’ll hit the cap faster than someone taking expensive brand-name drugs.

Once you hit $2,000 in out-of-pocket spending, you’re in catastrophic coverage. From that point on, you pay nothing for any covered drug - generic or brand - for the rest of the year. That’s a huge shift from just a few years ago, when you’d still pay 5% coinsurance even after the donut hole.

What Drugs Are Covered? The Rules

Not every generic is automatically covered. But CMS requires plans to cover at least 85% of drugs in each therapeutic class - and 100% for six protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants, antiretrovirals, and antineoplastics. That means if you’re taking a generic for depression or cancer, your plan must cover all available versions in that class.Plans can still use tools like prior authorization or step therapy. For example, they might require you to try one generic version of a drug before covering another. That’s legal, but it can be frustrating. A 2024 survey found that 23% of complaints about Part D were about generic substitution - like when your pharmacist switches your medication to a different generic your plan doesn’t cover, and you get stuck with a full-price bill.

Why Generic Coverage Is So Much Cheaper

Generics cost less because they’re chemically identical to brand-name drugs but don’t require the same research, testing, or marketing. The same active ingredient. Same dosage. Same effect. Just no brand name. And because multiple companies can make them, prices drop fast.In 2024, generics made up 92% of Part D prescriptions but only 18% of total drug spending. That’s the power of competition. One study found that beneficiaries using mostly generics saved an average of $1,200 a year compared to those on brand-name drugs. For someone on three or four daily medications, that’s hundreds of dollars in monthly savings.

What You Need to Do Every Year

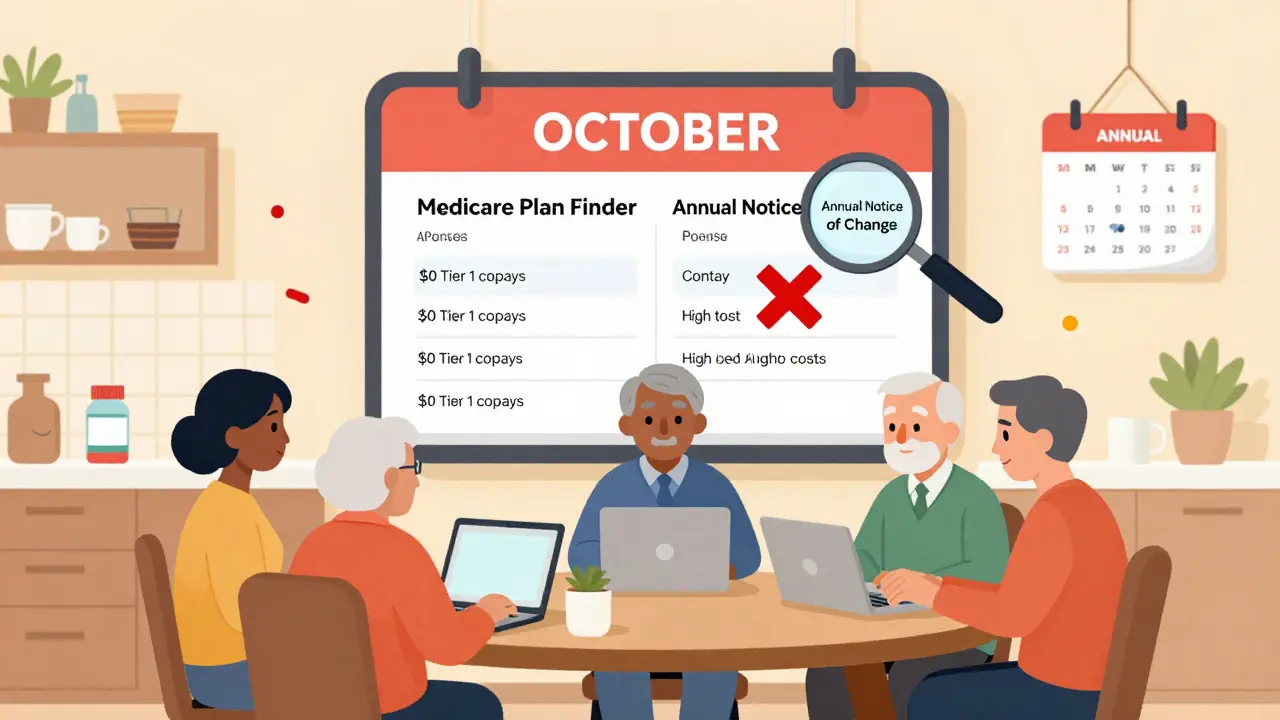

Formularies change. Every fall, your plan sends you an Annual Notice of Change. Read it. A generic you’ve been taking for years might move from Tier 1 to Tier 2. Or it might get dropped entirely. If that happens, you’ll pay more - or nothing at all.Use the Medicare Plan Finder tool. Don’t guess. Enter your exact medications - including the generic names - and compare plans side by side. KFF found that 61% of people who use this tool save at least $427 a year just by switching to a plan with better generic coverage.

Look for plans with a $0 deductible. About half of stand-alone Part D plans offer this in 2025. If you take a few generics a month, skipping the deductible can save you money right away.

What If Your Generic Isn’t Covered?

If your plan doesn’t cover a generic you need, you can ask for a coverage determination. That’s a formal request for the plan to cover the drug anyway. According to 2023 CMS data, 83% of these requests are approved - especially if your doctor explains why the covered generic won’t work for you.Some people have luck with therapeutic interchange. That’s when your doctor switches you to a different generic in the same class that your plan does cover. It’s not always possible, but it’s worth discussing. One Reddit user shared that after being charged full price for a generic blood pressure med, their doctor switched them to a different generic on their plan’s formulary - and their monthly cost dropped from $65 to $0.

What’s Coming Next

By 2026, Part D plans will be required to include a generic price comparison tool in their member portals. That means you’ll be able to see, right on your phone, which version of your generic drug costs the least - and which plan covers it best.In 2029, the Medicare Drug Price Negotiation Program will kick in. For the first time, the government will negotiate prices for certain generic drugs. Insulin glargine (the generic version of Lantus) is already on the list. That could bring prices down even further.

And there’s growing pressure to standardize tiers. Right now, one plan might put a generic in Tier 1, while another puts it in Tier 3. That’s confusing. The Medicare Payment Advisory Commission is pushing for all plans to cover the same generics in the same tiers. If that happens, choosing a plan will get a lot easier.

Real Stories, Real Savings

One beneficiary in Ohio told her story: she takes three generics - metformin, lisinopril, and atorvastatin. In 2024, she paid $120 a month. In 2025, she switched to a plan with $0 Tier 1 copays. Now she pays $0. She saves over $1,400 a year. She didn’t change her meds. She just changed her plan.Another man in Florida was paying $45 a month for his generic blood thinner. His plan dropped it from Tier 1 to Tier 2. He requested a coverage determination. His doctor wrote a letter explaining why the covered alternative wasn’t right for him. His request was approved. He kept his medication at the same low price.

These aren’t rare cases. They’re happening every day. And they’re possible because the system is designed to reward smart choices - especially when it comes to generics.

Final Tips: Don’t Overlook the Basics

- Always check your formulary every fall. Even if you’re happy with your plan, things change.- Use the Medicare Plan Finder. Enter your exact drugs. Compare plans. Don’t assume your current plan is still the best.

- Ask your pharmacist: "Is this the lowest-cost generic my plan covers?" They know the formulary better than most.

- If you’re on multiple generics, a $0 deductible plan might save you more than a plan with lower copays.

- If you hit the $2,000 cap, you’re done paying. No more coinsurance. No more surprises. Just free meds for the rest of the year.

Are all generic drugs covered under Medicare Part D?

Not every generic is covered, but Medicare requires plans to cover at least 85% of drugs in each therapeutic class. For six protected classes - like antidepressants, antiretrovirals, and cancer drugs - all available generics must be covered. Plans can exclude generics for weight loss, fertility, or cosmetic use, but those are rare. Always check your plan’s formulary to confirm.

Why do some generic drugs cost more than others on the same plan?

It’s about tier placement. Preferred generics (Tier 1) are cheaper because the plan has negotiated lower prices with manufacturers and encourages their use. Non-preferred generics (Tier 2) are more expensive because they’re either newer, less commonly prescribed, or have less competition. The same active ingredient can be on different tiers depending on the plan’s decisions.

Does the $2,000 out-of-pocket cap apply to all drugs, including brand-name ones?

Yes. Once you hit $2,000 in out-of-pocket spending for any covered drug - generic or brand-name - you enter catastrophic coverage. From there, you pay nothing for the rest of the year. For brand-name drugs, the 70% manufacturer discount counts toward your cap. For generics, only your actual payment counts. Either way, you’ll hit the cap faster if you’re taking mostly generics.

Can my pharmacist substitute a different generic without telling me?

Yes, unless your doctor writes "do not substitute" on the prescription. Pharmacists can switch you to another generic in the same class - even if it’s not on your plan’s formulary. That can lead to unexpected costs. Always ask your pharmacist: "Is this the exact generic my plan covers?" If not, you might have to pay full price until you get a coverage determination.

How often do Medicare Part D formularies change?

Every year. Around October, plans send out an Annual Notice of Change. About 37% of plans change at least one generic drug’s tier placement or remove it entirely. That’s why reviewing your plan each fall is critical. A drug you’ve been paying $5 for might jump to $40 - or disappear from coverage altogether.

What’s the difference between a generic and an authorized generic?

A generic is made by a different company than the brand-name drug. An authorized generic is made by the same company that makes the brand, but sold under a generic label - usually at a lower price. They’re identical in every way. But formularies sometimes treat them differently, leading to confusion. If you’re prescribed an authorized generic, make sure your plan covers it under the generic tier - not the brand tier.

Should I choose a plan based on my generic medications?

Absolutely. Your medications should drive your plan choice, not the other way around. Use the Medicare Plan Finder to enter your exact generic drugs. Look for plans that list them on Tier 1 with $0 or low copays. Don’t pick a plan because it’s cheap overall - pick it because it’s cheap for your specific drugs. People who do this save hundreds or even thousands a year.